What is Making Tax Digital?

The tax system is changing

HMRC says that its ambition is “to become one of the most digitally advanced tax administrations in the world”. It says that Making Tax Digital is ‘making fundamental changes to the way the tax system works’ – transforming tax administration so that it is:

- more effective

- more efficient

- easier for taxpayers to get their tax right

The government also hopes the move will avoid the tax errors that result in more than £9 billion worth of revenue a year.

You may well have already heard of Making Tax Digital, or MTD as it’s commonly referred to. There have been some well-known cloud accounting providers advertising their products for it on TV, and accountants have been begrudgingly writing about it for a couple of years now.

It's not just for VAT registered businesses any more

MTD for VAT is the first stage of this transformation of tax filing and record keeping, and means that businesses must now do their VAT accounting and VAT filing using software (desktop or cloud) and submit returns via the internet through digitally linked solutions. This actually became law on 1 April 2019.

If you’re currently VAT registered then this won’t come as a shock to you, and you’ll most likely have been in the group of applicable businesses that must now follow the new rules. You may well have already got your solutions in place and have been successfully filing – in which case, bravo! You should still read on though – there are changes coming to penalties and things are going to get a bit stricter.

HMRC will be reviewing the penalty regime over the coming years and making them appropriate for MTD (more on that later). So if you’re reading this and aren’t sure you’re fully compliant yet, it’s better to be safe than sorry and make sure that you become compliant right away. And we’ll tell you exactly what that means in real life.

In short, MTD for VAT currently means the following:

- VAT Returns must be filed through HMRC-approved software: VAT-registered businesses with a turnover above the VAT threshold (currently £85,000) must submit their VAT Return using compatible and approved software. There is a list of approved software suppliers on the HMRC website. This means that it’s no longer possible to submit VAT Returns directly via HMRC’s website as you’ve been able to do for years. Don’t panic though! Your accountant can still submit the VAT Return on your behalf or you can choose a piece of HMRC-approved software to use.

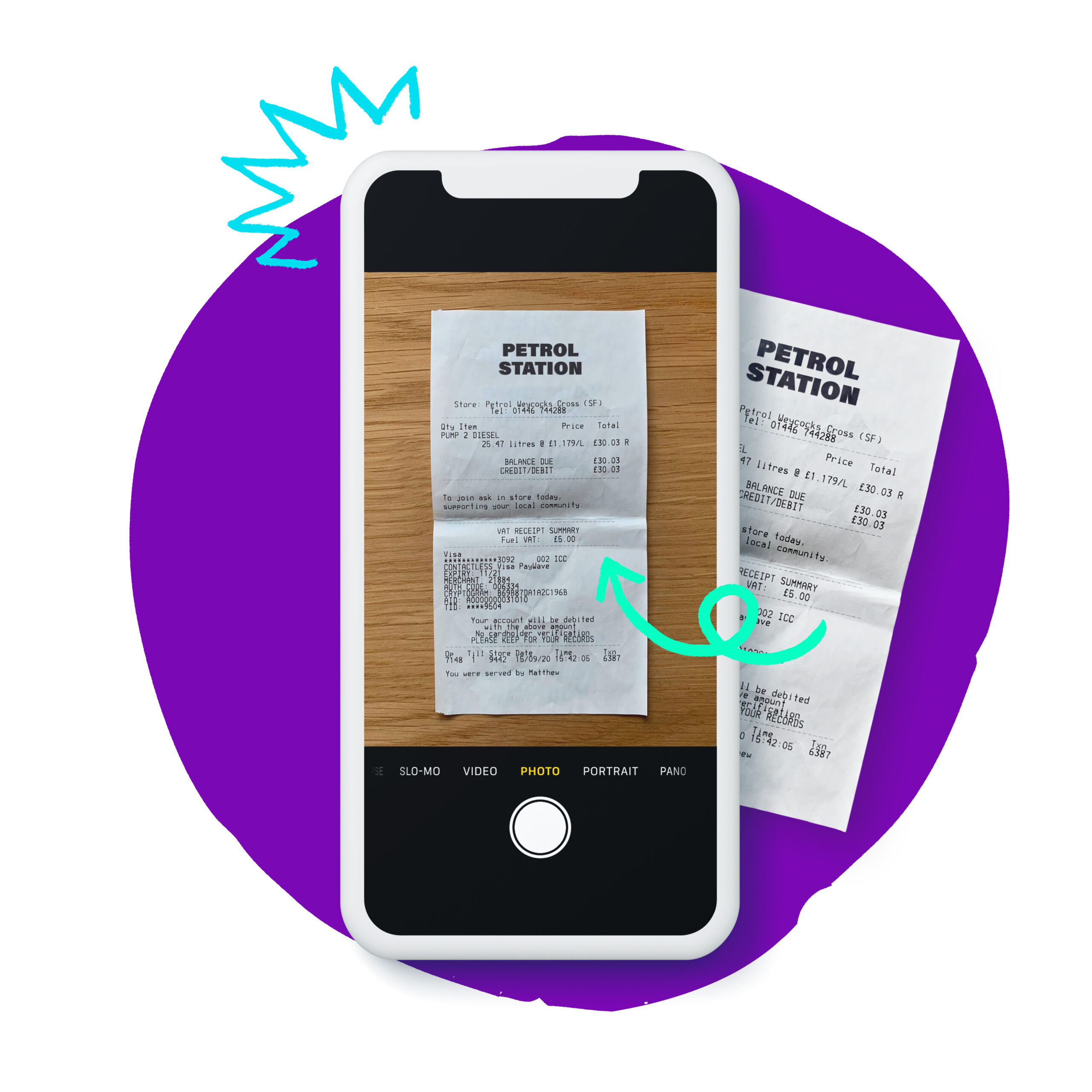

- Businesses must now keep digital records: We’ll discuss what the definition of a digital record is later on in this guide, but in summary – most VAT accounting records relating to the VAT Return must be kept digitally and/or using software for the statutory legal period of six years (10 years for mini one-stop shop (MOSS) businesses).

MTD for VAT applies to almost all of the VAT-registered businesses in the UK and it isn’t possible to swerve it or opt out apart from in very specific and rare circumstances.

MTD is here to stay

And it’s here to stay. In July 2020 HMRC announced their new roadmap which tells us the dates by which everyone must file in line with MTD:

VAT-registered businesses with a taxable turnover below £85,000 will be required to follow Making Tax digital rules for their first return starting on or after April 2022.

From 2026 any self-employed business, sole trader or landlord with income of over £50,000 will have to file under the Making Tax Digital Rules. Those with income over £30,000 will be mandated from April 2027 and the remaining small businesses’ timescales to be reviewed in the future.

It’s not all doom and gloom, though.

Over the years, our clients have found that making the switch to services like ours has provided a fantastic opportunity not only to become compliant with legislation like MTD, but to overhaul their entire accounting processes. It has enabled them to get on with running their business, drastically easing the administrative burden of dealing with their accounts and taxes.

How do I prepare for Making Tax Digital?

This may all sound a little daunting, but worry not! Mazuma is ideally placed to help business owners and sole traders to comply and MTD without any mistakes. In fact, we’ll do most of the legwork for you.