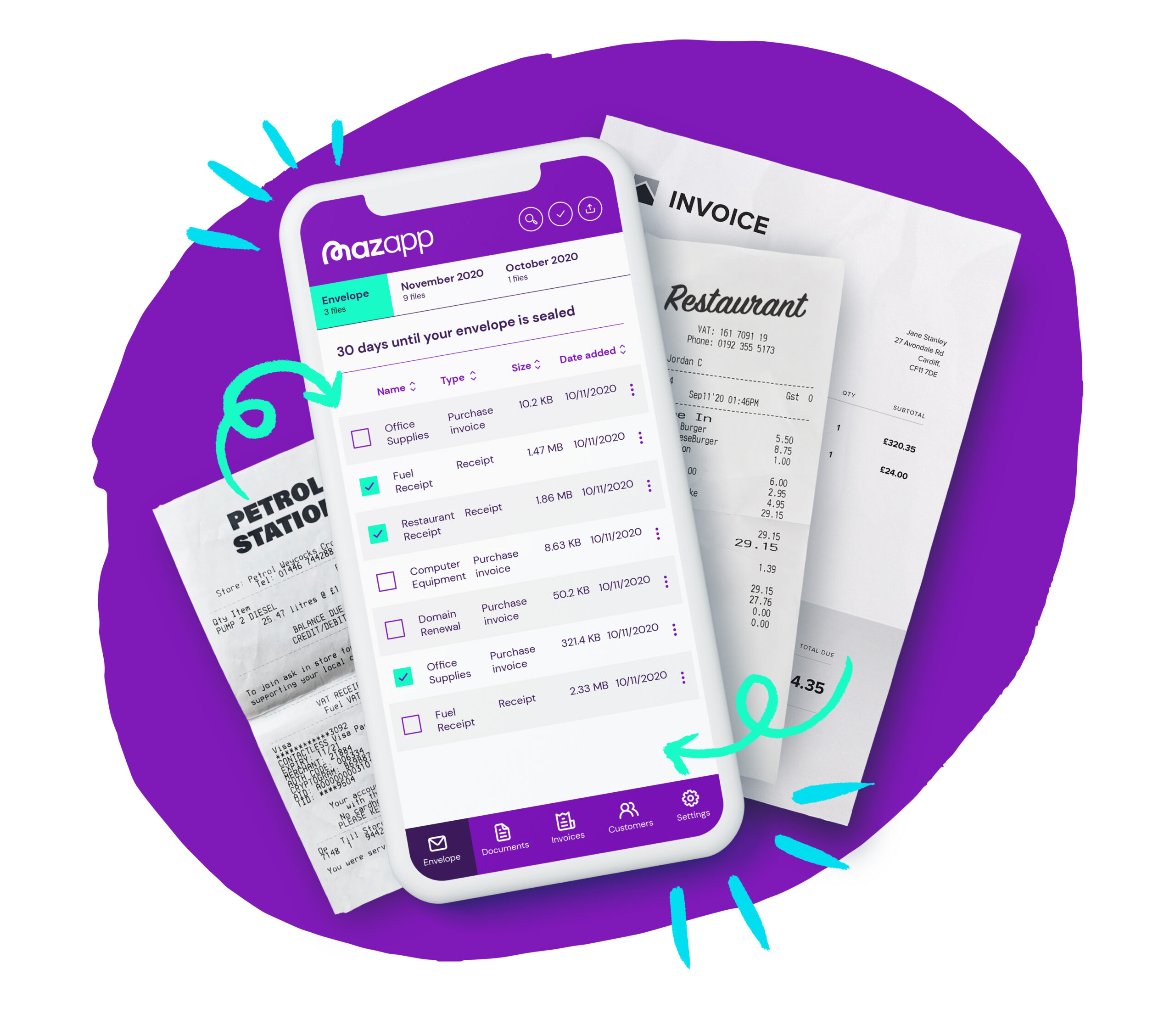

MazApp

Made for small businesses

We’ve developed our own software that is perfectly created for businesses just like yours. No need to the expense of a separate software subscription like Xero or QuickBooks, our software MazApp will do everything you need.

And the best part?

We won’t ask you to do any of the hard work yourself.

That’s right, no more data entry or bank reconciliations!

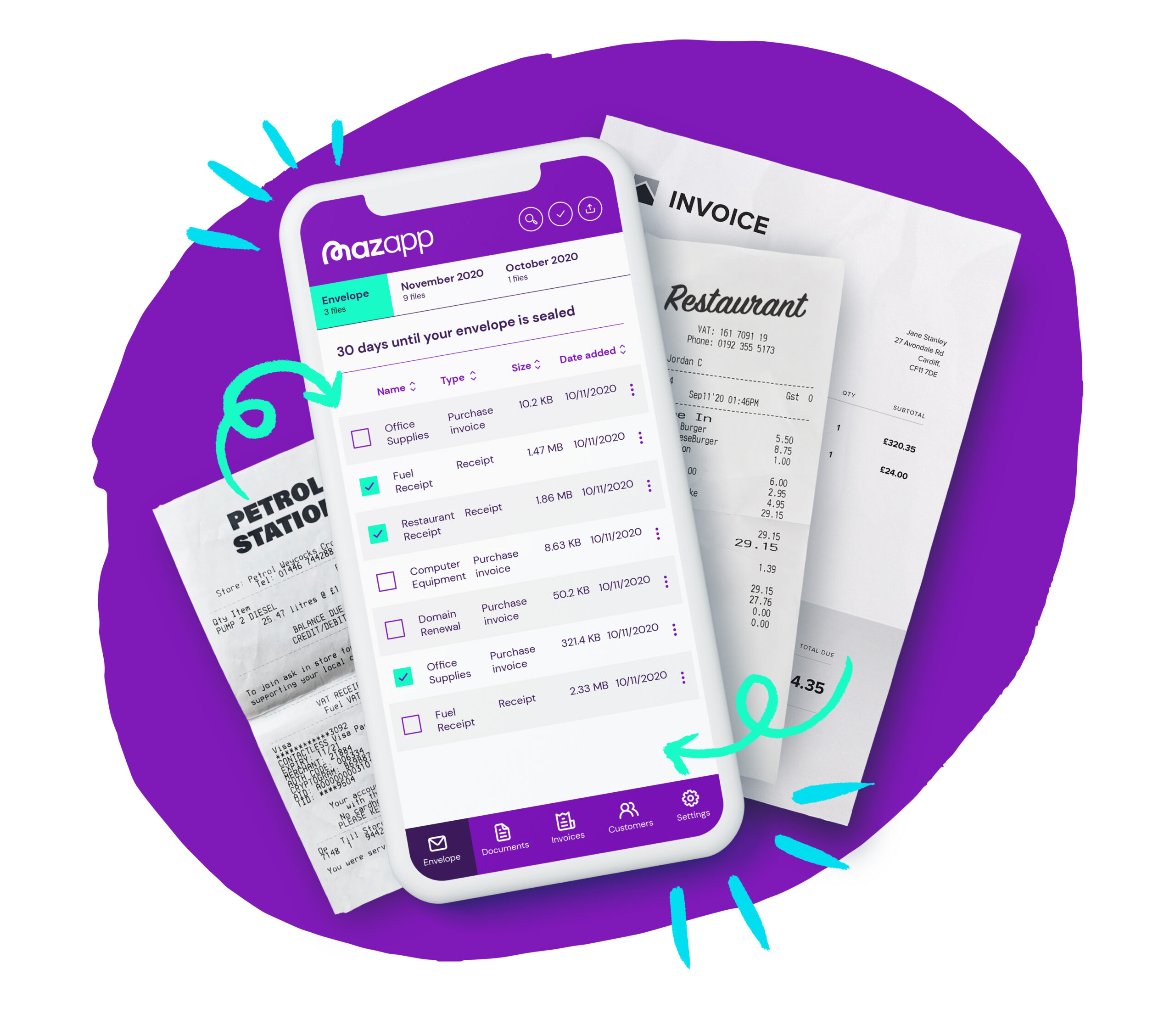

What does MazApp do?

Send invoices

MazApp allows you to send invoices, automatically chase payments, send statements to your customers, and get paid faster. All of your invoices are automatically sent to your accountancy team for review, so you can be assured that you’re getting it right from the off!

Upload documents

With MazApp you can snap and send your documents into your secure envelope, forward them in via email or upload them from your devices. All your documents are stored in one place for your accountancy team to review before they start doing the bookkeeping for your business.

Making Tax Digital

Our MazApp software has been approved by HMRC for Making Tax Digital (MTD), and can do all of your MTD filings.

VAT Returns

Our Accountants use MazApp to file your VAT returns to HMRC on your behalf – all fully MTD approved and with the peace of mind that your calculations are done by a qualified accountant every time.

Connect your Bank Account

Connect your bank account and credit card to MazApp, automatically download your transactions and send them straight to your accountancy team for review.

Bookkeeping

MazApp contains a full bookkeeping function that our Accountants use on your behalf. It takes your documents, receipts, invoices, and bank statements and turns them into monthly management accounts that our specialist accountants prepare for you. With MazApp handling the data entry and our accountants handling the technical stuff, you can be assured that your figures are correct at all times – letting you use them to make the right decisions for your business.

Bank reconciliation

One of the trickier aspects of bookkeeping is performing a bank reconciliation. MazApp will do this automatically for you! What’s even better is that you don’t have to remember to press a button or book time in to get it done – we schedule it automatically for you. All you have to do is upload your documents and we’ll do absolutely everything else.

File your Taxes

When you use MazApp you know that your taxes will be filed accurately and on time. Our specialist accountants not only use MazApp throughout the year to produce your monthly management accounts, but they will also file your accounts and tax return on your behalf. All you have to do is keep uploading your documents and we’ll do the rest.

Industry-leading Technology

We’ve created technology at Mazuma that is designed specifically for the needs of our clients. Only our clients and our team get to use the tech that we created. And we created our own because there was nothing out there on the market that we felt properly addressed the needs of our client base.

Don’t get us wrong – there is some incredible technology out there. But the problem we found was that, because it’s created for the mass market, it didn’t really fit the most common needs of our small and micro business clients:

- Ease of use – no faffing around with reconciliations or matching things off

- Time-saving – if the software only saves your accountant time and not you, it’s not the right thing for you!

- Reports you can rely on – real-time data sounds great, but it only works if you are absolutely sure that everything you have done it right. 96% of accountants have to correct their client’s data in software packages before they do their tax returns and accounts. So maybe that real time data isn’t that useful after all?

Cutting edge tech for everyone

With our own technology we developed a way for you to have the benefits of the most cutting edge and industry leading services, without having to spend your time using them. Our technology also comes completely free as part of your subscription with Mazuma – so no extra costs.

If you decide to send us in an envelope of paper receipts every month, our technology will scan, digitise, organise, extract and analyse your data before sending it to your accountancy team for review – every single month.

Or if you want to use our technology by uploading, using snap and send or using it alongside some of your other favourite tech – you can do that too.

Incredible Accuracy Rates

With a 99.7% accuracy rate, our data extraction tech ensures that all of your bookkeeping is accurate – so that your accountancy team can spend their time giving you advice, not picking through the pennies and pounds on your ledgers.

We let the technology do its job so that our humans can do theirs – giving you awesome advice!