Business Set Up - £350

Everything you need in one basket!

Setting up a business is as exciting as it is scary. You’ll be tingling with anticipation about the new life that you can lead, but also perhaps a bit apprehensive about all the extra work you’ll need to do to get yourself set up.

Don’t worry! We’re here to give you everything you need for your business – in one ‘basket’, for one low price!

Your business setup will go from overwhelming to awesome when you use our incredible Business Basket set-up service.

From company incorporation, to a bank account, legal templates, and more. We’ve got you covered.

Over £1000 worth of business services for just £350!

Included in the Business Basket Set Up service

Company Incorporation

We’ll register your company at Companies House, ensuring that all of the legal aspects are done correctly.

Whether you’ll be trading through the company as a Limited Company immediately or are a sole trader that wants to save their company name for later, we’ll make sure that you’re covered.

Registered Office Service

Protect your personal address with our Registered Office service. Get all your documents delivered to you electronically without needing to put your address on the public register.

Our registered office service will mean that you can keep your home address private and use our address for your business. We’ll take delivery of your post, scan it and email it to you for 12 months.

Discounted Business Bank Account

When you run a business, it’s vital that you have a business bank account to keep your business finances separate from your personal finances.

It’s a legal obligation for a Limited Company to have a separate business bank account and is highly recommended for a sole trader. We can help you apply for one of the most competitive business bank accounts on the market, and you’ll get an exclusive discount, plus your account number and sort code in just hours!

Card Reader

We’ll send you out a card reader to make sure that getting paid is as easy as a tap!

You can start accepting payments by credit or debit card, so there’s no more chasing customers for cash or waiting for them to make a bank transfer to you. Transaction Fees apply.

Insurance Assessment

We’ll ensure you’re covered appropriately for the type of business you run with an insurance assessment through our dedicated partners.

Their experts will talk you through the risks to you and your income, and how you can protect yourself.

Law Package

A business essentials law package with our Partners will include all the basics you’ll need to get you started on your business journey.

You can be assured that you’re legally compliant from day one – another weight off your shoulders!

Co-working space

Running a business can be lonely or can take over your house!

But don’t worry, you’ll have a free day pass and an exclusive discount on our network of co-working spaces with this package.

Tax consultation

Our experts will provide you with a consultation to make sure that you’re operating with the best tax strategy for your business.

Accounting consultation

Our accounting experts will provide you with a consultation to check that your accounting systems and registrations are correctly set up.

Not having the right business structure, or not having all of your HMRC and Companies House documents in order can lead to hefty fines. In our consultation, we’ll ensure you have nothing to worry about.

Business Funding Set-Up

Our funding partners will get you set up on their system, making sure that you have access to the most extensive and varied options when it comes to funding your business venture.

Discount on our Accounting package

If you have set your business up with us, you’ll receive some hefty discounts on your first year with us as your Accountants.

If there’s one thing that you shouldn’t delay doing, it’s hiring an accountant to take care of your accounts and tax. Here at Mazuma. we’re the best in the business for small businesses and the self employed.

Buy your Business Set Up Service Now!

Business Set-Up FAQs

Should I trade as a Limited Company?

Trading as a Limited Company can offer many benefits but is significantly different from operating as a sole trader. A Limited Company is a business registered with Companies House and is run by Directors, and usually owned by shareholders. You can be the only director of your company or have multiple directors with different levels of ownership based on their shares in the company.

Limited Companies require more paperwork and admin work than a Sole Trader business, but they also provide more protection, as any business debts are held by the company – not by you personally. This is called limited liability. That said, most business borrowing does require directors to sign a guarantee nowadays! So you should always talk to an accountant about the right structure for your business idea.

Limited Companies are also usually more tax-efficient than Sole Traders. Directors also have more options in terms of income tax, as you can decide to take a salary, dividends or a combination of the two. However, it’s important that you engage with an accountant to let you know how to structure your pay, as getting it wrong can cost you a fortune in tax!

Can I have a Limited Company if I am a sole trader?

When you start a business, one thing you’ll want to do is protect your business name. After all, starting a business is complicated enough without the risk of someone else having your business name if you want to incorporate and trade as a limited company later on.

Lots of our clients register their company name at companies house just to protect their business name – even if they don’t intend to use the limited company straight away. Then they’ll simply ask us to take care of the dormant accounts for them until they’re ready to trade as a limited company at a later date.

Always speak to an accountant about the best structure for your business idea.

Do I need a business bank account?

Whether you legally need a different bank account or not depends on the business structure of your new business. Many small businesses are not aware that there are different banking requirements depending on the type of business you are running.

If you operate as a sole trader or self-employed, then legally speaking, there is no need to set up a business bank account. However, it’s a really good idea to have a separate business bank account, even if you are self-employed, because you can keep your business finances separate from your personal finances.

When you run a small business, no matter the business structure, keeping your finances neat and tidy is a good idea!

If you trade through a limited company, then you legally have to have a business bank account. This is because your business structure means that the limited company is a separate legal entity to you personally and so requires its own bank account.

With our business start-up service, we’ll open you a bank account with one of the leading business banks – helping your business idea become a reality.

How can I take payments for my business?

It’s all well and good having a great business idea and starting a business – but none of that will matter if you can’t get paid for your product or service!

One of the most common reasons that new businesses fail is due to cash flow issues. So let’s make sure that your product or service includes an easy way for people to pay you!

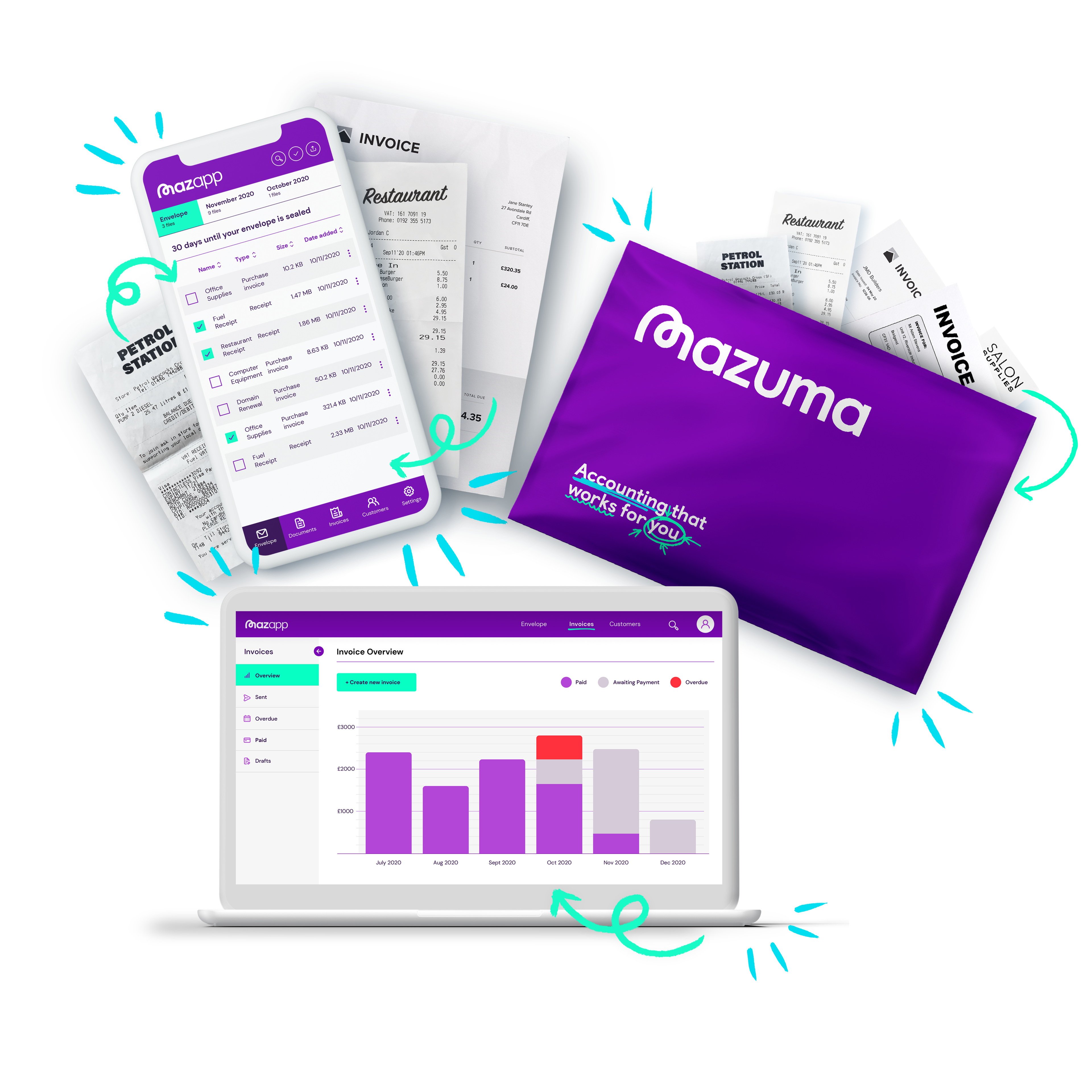

At Mazuma, our invoicing software that is included in the service includes a way for people to pay you directly from their bank account. But if you don’t send formal invoices because perhaps you are a tradesperson or a shop or cafe, how can you get that cash into your business bank easily?

This package includes a card reader to allow your customers to pay for your product or service with a simple tap of their credit or debit card – how easy is that? And what’s even better is that you won’t have to spend hours researching the best provider; we’ve already done that for you. We know that small businesses have enough to worry about without spending hours finding the best suppliers to support their business ideas, so that’s why we’ve done the hard work for you.

Who do I need to register with?

When starting a business, you’ll need to register with HMRC and Companies house, as well as make sure that your new business is registered with places like the ICO if necessary. Your legal structure will dictate where you have to register and where your business name and official limited company name need to be displayed. It’s fair to say that setting up a business is no mean feat!

Luckily, we’ve made setting up a business so much easier with our set up package. We’ll get on with making sure that your new business is registered in all the right places, and you can get on with your business plan to sell your product or service!

What is the right legal structure for my new business?

Selecting the right business structure for your new business is crucial. The wrong business structure can not only land you in hot water when it comes to your tax bill, but it could put off potential customers from buying your product or service if the business structure doesn’t align with your business model.

You should always speak to an accountant when deciding on the legal structure of your business. It’s also a good idea to speak to a lawyer to make sure that you have all of the right legal documents for your business model.

Our package puts you in touch with both accountants and legal experts, as well as tax experts, business insurance experts and a business bank, to make sure that your new business is off to the best possible start.

Why should I buy this package?

You could source all of the services included in this package separately, but it would take you a long time and cost you a lot of money! You’ve decided to create a business, and you should be thinking about how to create a website, writing a business plan, and perfecting your marketing and sales – not faffing around looking for business insurance and trying to figure out what limited liability really means for you!

This package is ideal for the type of business owner who not only values their time and understands the importance of focussing on the right areas of starting a business, but who also knows that Mazuma is the expert when it comes to your small business – and we have the little black book to prove it!

Our track record of helping small businesses create a business that thrives means that our partners and in-house experts really are the best choice for small businesses. That’s why we created this package – it’s the perfect way for small businesses to get their hands on everything they need in one place.

So if you want to run the type of business that excels in its first 60 days, then this is the right package for you!